Minnesota Gambling Control Board Forms

Posted By admin On 25/07/22If the organization terminates lawful gambling and the loan has not been repaid, the loan repayment will be included in the terms of the license termination plan. Access form LG272, Request for Lawful Gambling Account Loan to General Account, here. Minnesota Gambling Control Board June 1 Lawful Gambling Restart –. The Minnesota Gambling Control Board states that, “charitable gambling is conducted only by registered, nonprofit organizations”. There are five forms of lawful gambling; pull-tabs, bingo, raffles, paddlewheels, and tipboards.

The Minnesota Gambling Control Board states that, “charitable gambling is conducted only by registered, nonprofit organizations”. There are five forms of lawful gambling; pull-tabs, bingo, raffles, paddlewheels, and tipboards. In order to be eligible to conduct lawful gambling, the Minnesota Gambling Control Board requires proof of nonprofit status. Furthermore, in order to conduct lawful gambling, you must be a religious, veteran, nonprofit, or fraternal organization. From there, your organization would require either an IRS income tax exemption 501(c) letter in your organization’s name or an IRS letter showing that the parent organization is a nonprofit 501(c) and that they recognize you as a subordinate.

At Clasen & Schiessl CPAs, Ltd., we offer all of the following monthly gambling services:

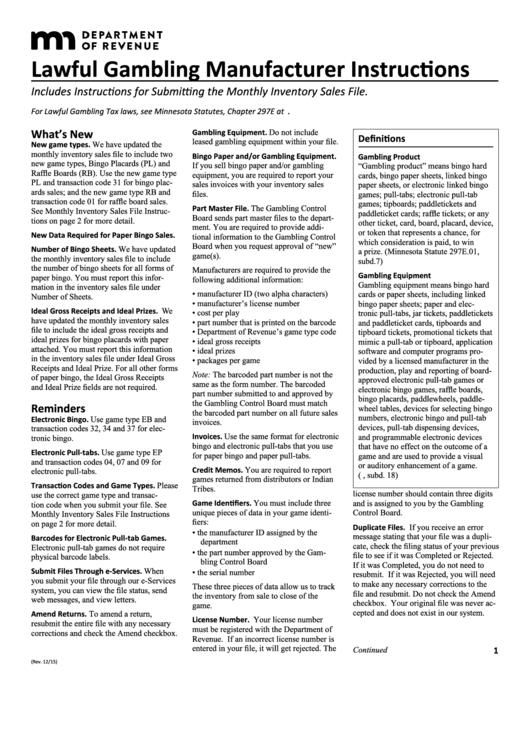

- Preparation of Minnesota Revenue Form G1 Lawful Gambling Monthly Tax Return including electronic submission and confirmation of on-line tax payment

- Preparation of Minnesota Lawful Gambling Schedules LG100A, LG100c, and LG100F including submission to Gambling Control Board

- Maintenance of gambling worksheets E, LG216, LG267, and LG1012

- Checking account reconciliation

- Posting of gambling receipts and disbursements

- Posting of adjusting journal entries

- Preparation of monthly net profit and star rating report

- Review all Minnesota Revenue and Lawful Gambling Correspondence

- Prepare annual Federal Form 11-C and monthly Federal Form 730 Excise Tax Returns

- Preparation of all quarterly and annual payroll tax forms, including electronic submission or related payroll taxes

Minnesota Gambling Control Board Forms Against

Minnesota Gambling Control Board Forms Template

To learn more about how we can assist your organization with lawful gambling, please contact us!